Should We Be Looking at Unemployment Numbers Differently? it has been a problem before the pandemic, but now is a big problem that we have to keep in mind, let’s do out part to help in this crisis.

The New York Times recently ran an article regarding unemployment titled: Don’t Cheer Too Soon. Keep an Eye on the Core Jobless Rate. The piece suggests we should look at unemployment numbers somewhat differently.

The author of the article, Jed Kolko, is a well-respected economist who is currently the Chief Economist at Indeed, the world’s largest online jobs site. Previously, he was Chief Economist and VP of Analytics at Trulia, the online real estate site.

Kolko suggests “the coronavirus pandemic has broken most economic charts and models, and all the numbers we regularly watch need a closer look.” He goes on to explain that the decline in the unemployment number reported by the Bureau of Labor Statistics (BLS) earlier this month was driven by a drop in temporary layoffs.

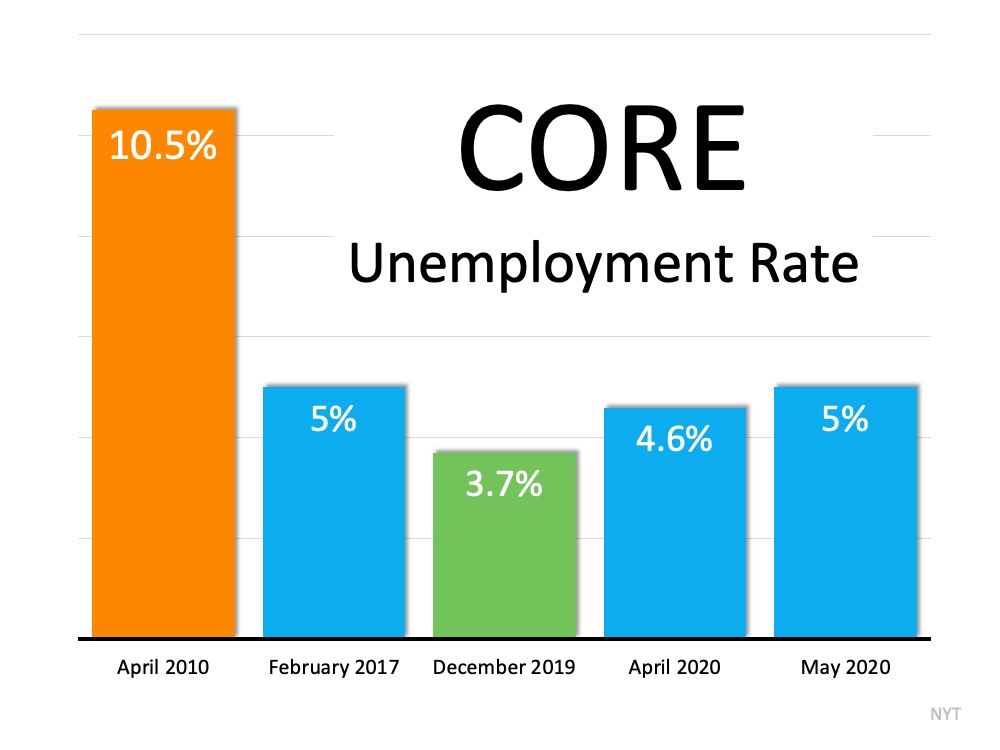

If we strip those out, we’re left with what Kolko calls the core unemployment rate. Many economists have struggled with how to deal with the vast number of temporary layoffs, as a complete shutdown of the economy has never happened before.

As the article states, in the last unemployment report:

“73 percent of all unemployed people said they were temporarily unemployed, which means they had a return-to-work date or they expected to return to work in six months. Before the pandemic, temporary unemployment was never more than one-quarter of total unemployment.”

–The Bad News and the Good News

Clearly, the adjustments Kolko makes dramatically impact the way we look at unemployment.

The bad news is, using his core rate, there was an increase in unemployment numbers from April to May.

The conventional rate reported by the BLS showed a decrease in unemployment.

The good news is that the core rate compares more favorably to the last recession in 2008. Here’s the breakdown:

–Bottom Line

The unemployment rate is a key indicator of how the economy is doing. Heading into a highly contested election this November, the BLS report releasing next week will be scrutinized like no other by members on both sides of the aisle.

Connect with me on Facebook for updates and information.

– Get your San Antonio Home Valuation Here

[showcaseidx_hotsheet name=”San Antonio – ALL – H”]